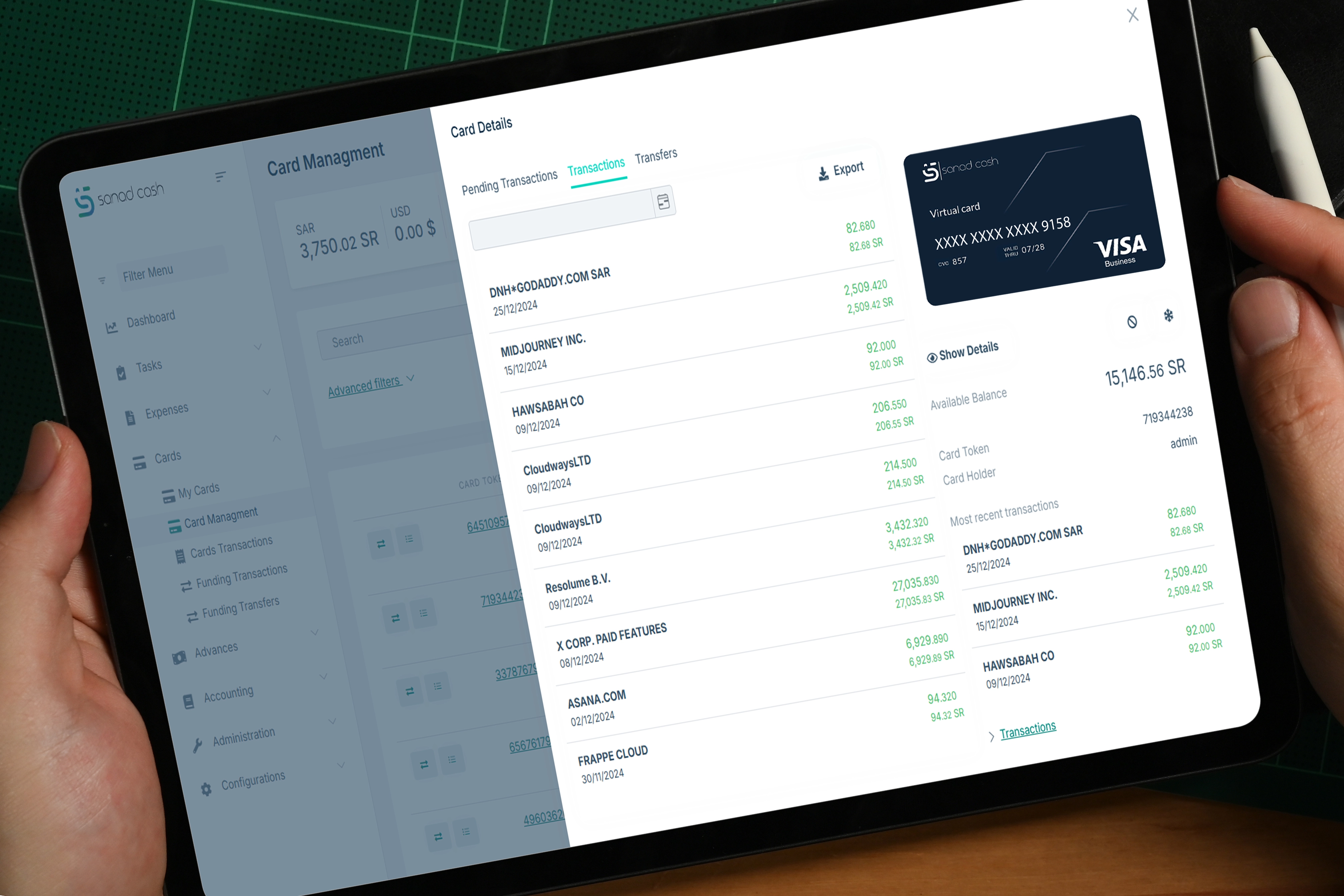

Sanad Cash, the simple way to manage business spend

Onboard your business and issue cards instantly.

Get your team onboarded and issue virtual & physical cards with just a few clicks

Get startedSet spend controls and track transactions in real time.

Customize spending limits, monitor transactions, and gain full visibility into every purchase

Get startedAutomate approvals, reporting, and reconciliation seamlessly.

Set up custom approvals, categorize expenses, and generate accurate reports automatically

Sanad Cash: One solution that meets all needs.

Sanad Cash automates spend tracking and reconciles transactions effortlessly, saving time and improving accuracy. Finance teams gain real-time visibility, streamline reporting, and reduce the risk of errors and fraud, all while maintaining full control over budgets.

Sanad Cash simplifies travel and expense management, per diems, travel costs, and reimbursements. The teams gain real-time control over expenses, reduce administrative work, and ensure compliance, making travel and expense management more efficient and effortless.

Sanad Cash facilitate managing project spending, setting spending limits, and tracking costs in real time. Operations team can efficiently handle petty cash and eliminate the manual effort of submitting claims, ensuring projects are on track with minimal administrative work.

Sanad Cash helps marketing teams manage campaign budgets and track spend, while IT teams can efficiently handle subscriptions and software expenses. Virtual instant cards simplify online purchasing for both teams, ensuring accurate reporting, compliance, and smoother operations across departments.

Sanad Cash gives employees access to prepaid cards, eliminating the need for cash. The mobile app enables them to manage spending on the go, while automated receipt capturing ensures accurate expense reporting and compliance, saving time and reducing manual work.

A simple and effective process that covers all bussiness needs

Set up

Define categories and departments, establish spending policies and rules, set spending limits, and add projects. This step configures the system to match your business structure and needs.

Invite

Send invitations to employees, define their roles and permissions, and allow them to activate their accounts. This step ensures that your team is set up with the right access and ready to start managing their spend.

Top-up

Issue cards to employees, fund them in real time, and set transaction limits and spending methods to ensure control and compliance across all purchases.

Track

Monitor transactions and spending in real-time, ensuring full visibility of all purchases. Automated receipt collection helps maintain accuracy, while keeping you on top of your budget and identifying potential issues early.

Report

Automate the generation of detailed reports on transactions, spending, and reimbursements. This step ensures accurate, timely reporting and automated reimbursement tracking, helping you stay on top of your spending and maintain financial control.

FAQs

Find answers to commonly asked questions about Sanad Cash

Yes, Sanad Cash follows highe security standards, including local hosting, PCI DSS certification, and compliance with verification requirements. Your business data is protected with robust security measures to ensure safe and secure transactions at all times.

Employees are onboarded with Sanad Cash by being added to the system by the authorized administrator, completing KYC procedures, and passing legitimacy checks. Once approved, they set up their accounts, receive their prepaid corporate cards, activate them, start spending, and track their spends via Sanad Cash app or web portal.

Sanad Cash cards can be used at any POS (Point of Sale) terminal, for online purchases, and for ATM cash withdrawals. This provides employees with the flexibility to make business-related transactions in various ways, both digitally and in person.

Yes, you can set spending limits through the card controls. You can define where the card can be used—whether at ATM, POS, or online. Additionally, you can set daily and monthly limits for each type of transaction, and even control limits on transaction level.

Sanad Cash is ideal for businesses of all sizes, from startups to large enterprises, across various industries like tech, construction, marketing, and services, helping manage company spending efficiently.

Yes, Sanad Cash offers dynamic approval workflows, allowing spending to be reviewed and authorized at the right levels within your organization. Workflows can be customized based on structure, projects, and category levels.

Prepaid corporate cards are payment cards issued to employees or departments within a company that are pre-loaded with a specific amount of funds. These cards are used to manage and control business related expenses, such as petty cash, travel, office supplies, online subscriptions, and other operational costs.

Yes, Sanad Cash enables you to issue both physical and virtual prepaid cards, offering flexibility for employees to make purchases in person or online.

To register your business in Sanad Cash, visit our registration page on the website. You will need to provide essential business details and contact information. Once registered, you can configure your account and invite your employees to get started. Alternatively, you can fill out our contact form, and our team will reach out to guide you through the onboarding process

To top up Sanad Cash prepaid corporate cards, customers can transfer funds from their bank account to the assigned IBAN provided by Sanad Cash. Funds appear in your Sanad Cash balance, and the account administrator can then allocate them to employees' card accounts.

You can track your team's spending in real time via Sanad Cash platform, which gives you full visibility into transactions, receipts, and spending patterns, with full control over cards and spending policies.

Sanad Cash automatically captures receipt information for card purchases. You can also use a QR reader and intelligent scanner. Even online receipts are handled automatically by the platform, creating draft expenses with accurate details, saving time and reducing manual input.

Sanad Cash enforces compliance with pre-spending limits, card controls, and a post-spending module that automates rules and policies, ensuring purchases align with company policies and reducing non-compliance risk.

Yes, Sanad Cash is perfect for project-based companies, like construction, contracting, and services companies. You can track spending and set approval workflows specific to each project, ensuring full control and compliance across all your projects.

You can instantly freeze or cancel any employee's card directly through Sanad Cash platform or mobile app, ensuring full control over card security and usage.

Sanad Cash is committed to providing exceptional customer support. If you encounter any issues or have questions, you can reach our dedicated team by emailing info@sanadcash.com, or by contacting us on mobile number 0551250840.

We offer assistance through various channels, ensuring you receive timely and effective help

Simplify spend management and fuel your business growth

Take control of your spend with our seamless and automated solution.

Start today!