Product Features

Product Features

Powerful features, designed to simplify your business spending

Discover how Sanad Cash helps you manage your business spending with ease. Our platform is built to provide control, improve processes, and support your growth, all with efficiency and simplicity.

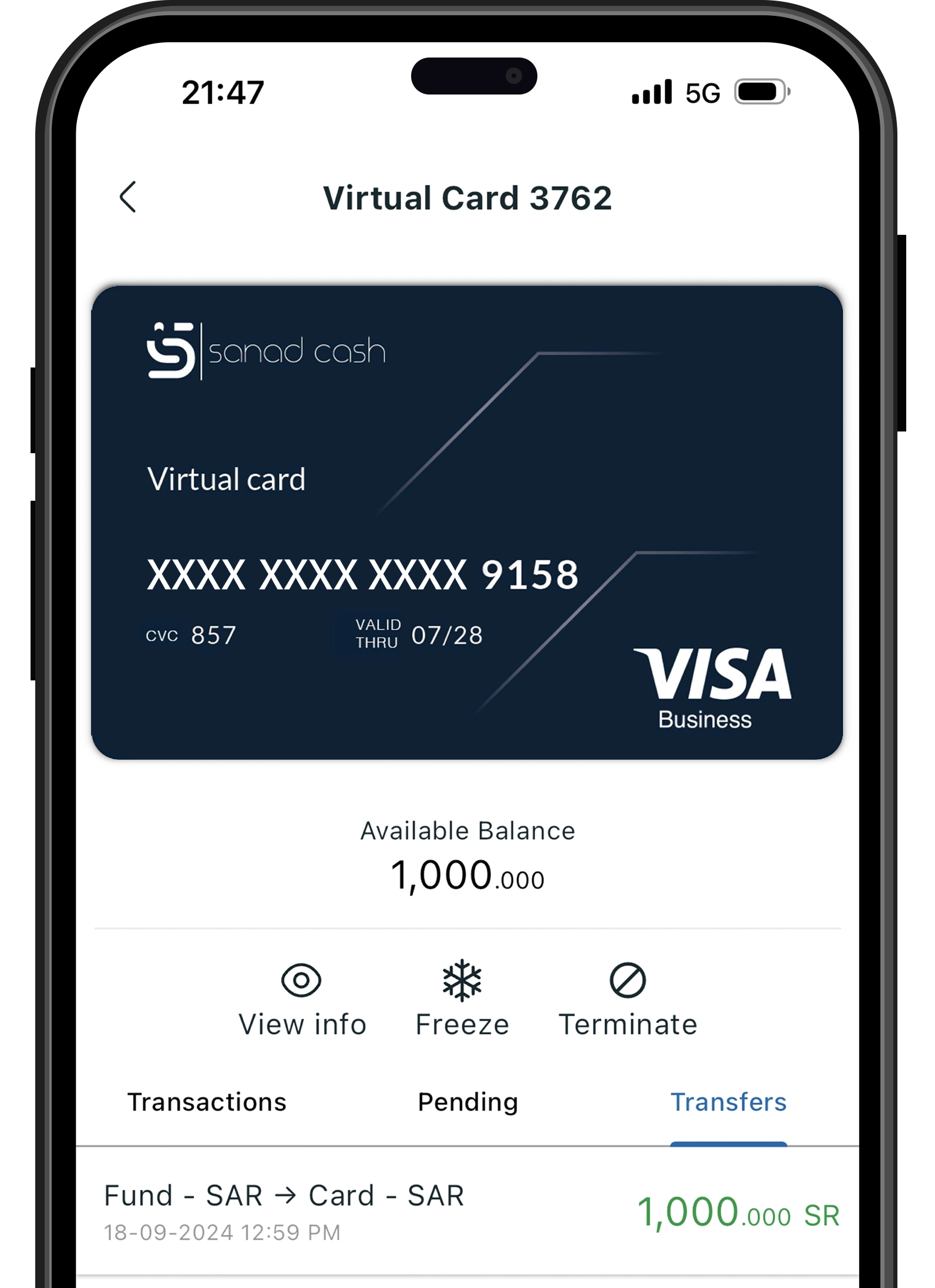

Effortless card issuing and spend management

Sanad Cash simplifies card issuing and spend management with instant virtual and physical prepaid cards, seamless onboarding, and a fully integrated platform that brings everything you need into one place.

Local card issuing program with a seamless onboarding journey: Easily issue prepaid cards locally with a quick and simple onboarding process, getting your business up and running fast.

Instant issuing for virtual & physical prepaid cards: Issue virtual and physical prepaid cards instantly, providing immediate access to funds for your team.

Integrated card & spend management platform: A unified platform that combines card management and real-time spend tracking for full control over your business spending.

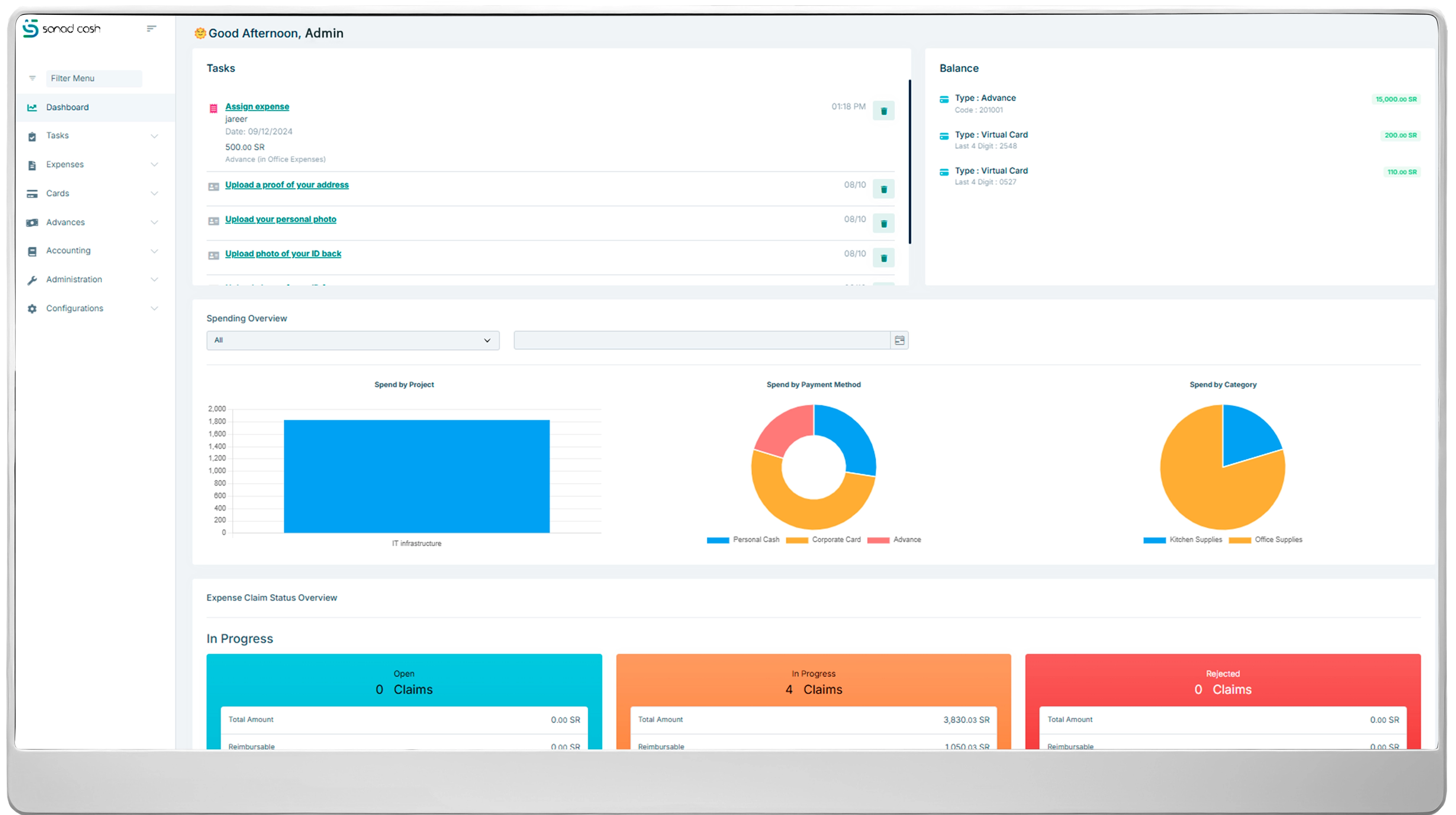

Enhanced control and visibility

Gain full oversight of your business spending. With Sanad Cash, you can manage real-time funding, set pre-spending controls, and ensure accountability through dual approval workflows—all designed to keep your finances secure and efficient.

Real-time funding and control over cards: Instantly fund cards and manage transactions in real time, giving you full control over business spending.

Pre-spending controls & limits for cards: Set customized spending limits and controls for each card, ensuring you stay within budget and maintain financial discipline.

Dual approval (Maker-Checker) for card creation & funding: Enhance security with a dual approval process for card creation and funding, ensuring that all transactions are properly vetted.

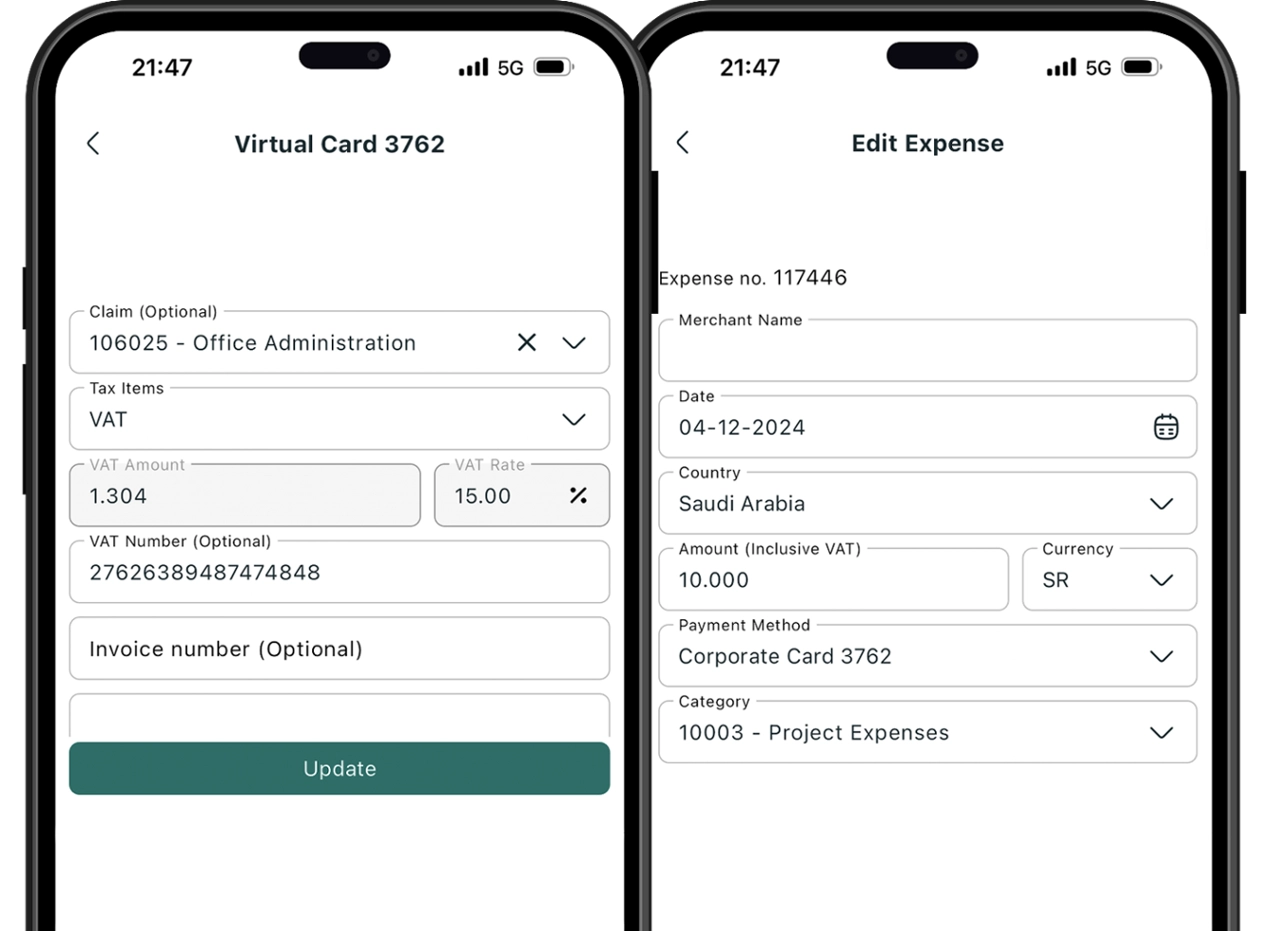

Seamless automation and efficiency

Sanad Cash takes the hassle out of managing expenses with automated draft expenses creation, reimbursement tracking, and post-spending rules. Simplify workflows, reduce errors, and save time with a platform built to handle it all seamlessly.

Automated draft expense creation for card purchases: Automatically generate expense drafts for card purchases, saving time and reducing manual entry.

Reimbursement tracking & accounting reports: Effortlessly track reimbursements and generate accounting reports, streamlining your financial processes.

Post-spending automated rules & policies module: Apply automated rules and policies after spending to ensure compliance and reduce errors.

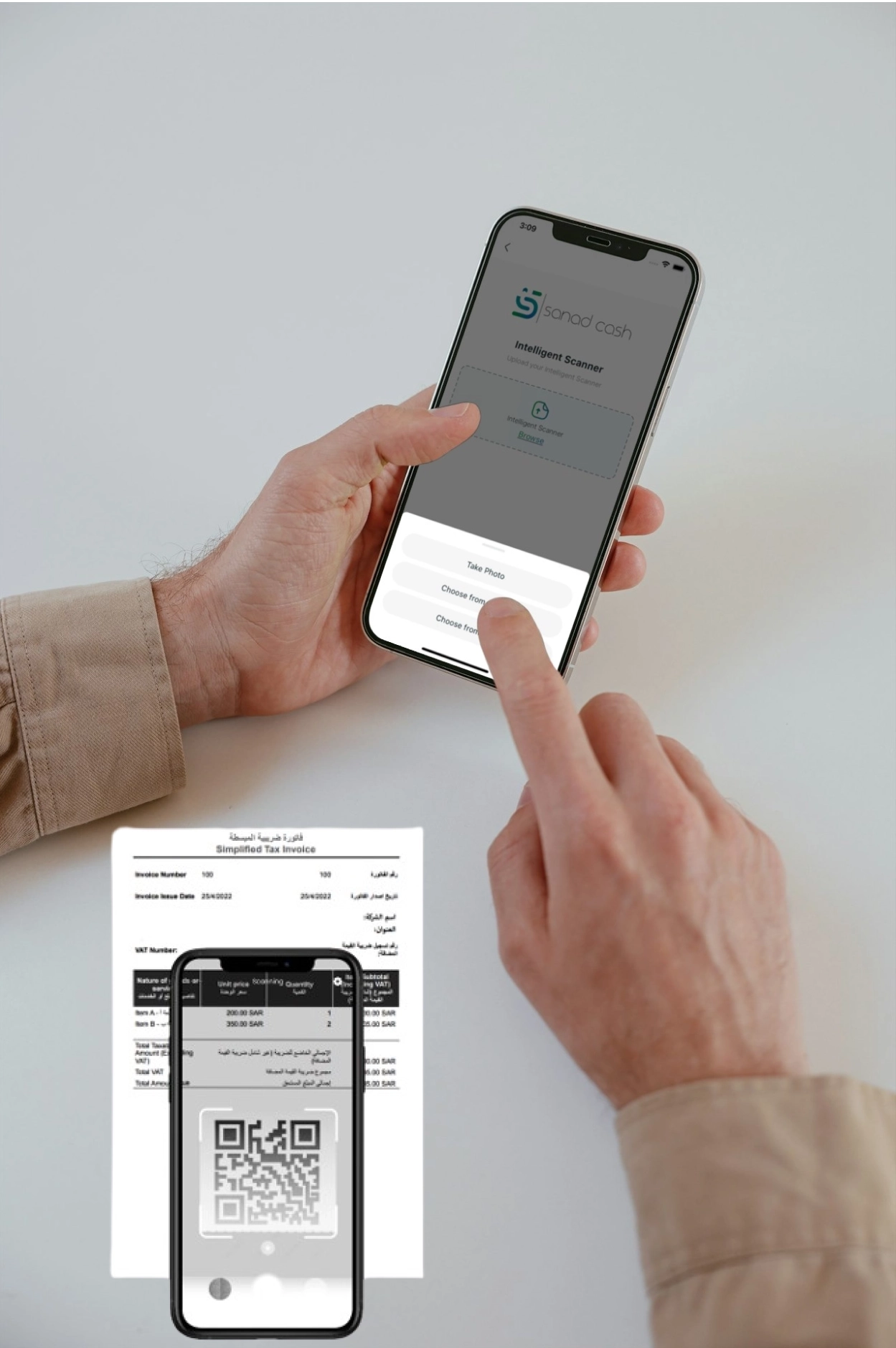

Smarter expense capturing and tracking

Effortless expense management with advanced tools like QR reader and OCR technology for receipt capturing. Combine that with dynamic approvals and cost categorization to simplify processes, ensure accuracy, and keep your business running smoothly.

Receipt capturing with QR reader & OCR technology: Easily capture receipts using QR codes and OCR technology for quick, accurate data entry.

Dynamic approvals and cost categorization features: Customize approval workflows and categorize costs dynamically to ensure accurate tracking and compliance.

Transactions reconciliation automation: Automate the reconciliation of transactions and receipts, ensuring accuracy and reducing manual effort.

Robust security and compliance

Protect your business with top-tier security standards. Sanad Cash ensures data security with local hosting, complies with PCI DSS requirements, and meets verification requirements to safeguard your operations—so you can focus on growth with peace of mind.

Strong security standards and measures: Top industry-leading security practices implemented within the system to safeguard your business operations and transactions.

Verification requirements compliance: Compliance with all necessary verification requirements to maintain transparency and trust.

Local hosted solution complied with PCI DSS: Take advantage of local hosting for compliance and PCI DSS certification to meet global payment standards.